How to Open a Business Bank Account in 2024: Step-by-Step Instructions

How to Open a Business Bank Account in 2024: Step-by-Step Instructions-Opening a business bank account is a crucial step for any entrepreneur in 2024. It helps you manage your finances, keeps your personal and business transactions separate, and can even enhance your credibility with clients. While the process can seem daunting, it’s quite straightforward if you follow these step-by-step instructions. Let’s walk through how to open a business bank account in 2024!

Step 1: Determine Your Business Structure

Before you dive into the banking world, you need to understand your business structure. Common structures include:

- Sole Proprietorship: Owned by one individual, often with minimal paperwork.

- Partnership: Owned by two or more individuals who share profits and responsibilities.

- Limited Liability Company (LLC): Offers liability protection for owners while allowing flexibility in management.

- Corporation: A more complex structure, often suited for larger businesses.

Your business structure affects what documentation you need to provide when opening your account, so clarify this first.

Step 2: Gather Required Documentation

Once you know your business structure, gather the necessary documents. Most banks will require:

- Employer Identification Number (EIN): This is essential for tax purposes. You can apply for an EIN through the IRS website if you don’t already have one.

- Business License: Depending on your location and industry, you might need a specific license to operate.

- Operating Agreement: If you’re an LLC or partnership, having a clear operating agreement can help.

- Partnership Agreement: For partnerships, this document outlines each partner’s responsibilities and share in the business.

- Personal Identification: Banks will typically ask for a government-issued ID, like a driver’s license or passport, from all account signers.

Having these documents ready will streamline the account opening process. (Read More: Business Trends in the Technology Sector Making the Most Profits)

Step 3: Research Different Banks

Not all business bank accounts are created equal. Take some time to research different banks and their offerings. Consider the following factors:

- Fees: Look for accounts with low or no monthly maintenance fees.

- Transaction Limits: Understand how many transactions are allowed without incurring extra fees.

- Online Banking Features: In today’s digital age, a user-friendly online banking platform is essential.

- Customer Support: Reliable customer service can be invaluable, especially when you encounter issues.

Read reviews, ask fellow entrepreneurs for recommendations, and compare multiple banks to find the best fit for your business.

Step 4: Choose the Right Account Type

Once you’ve selected a bank, it’s time to choose the right type of account. Most banks offer various options, such as:

- Business Checking Accounts: Ideal for daily transactions, payroll, and managing cash flow.

- Business Savings Accounts: Perfect for setting aside funds and earning interest on your balance.

- Merchant Accounts: Necessary if you plan to accept credit card payments.

Choose an account type that aligns with your business needs, and don’t hesitate to ask the bank for advice.

Step 5: Visit the Bank or Apply Online

In 2024, many banks offer the convenience of online account opening. However, some entrepreneurs still prefer the personal touch of visiting a branch. Here’s what to expect:

Online Application:

- Fill out the online application form, providing your business and personal information.

- Upload the required documents. Ensure they’re clear and legible to avoid delays.

- Review your application before submission to check for errors.

In-Person Visit:

- Schedule an appointment if required. Some banks prefer this to manage their foot traffic.

- Bring all your documentation and identification.

- Discuss your business needs with a banking representative, who can guide you to the best account option. (Read More: How to Land High-Paying Business Administration Jobs in Today’s Market)

Step 6: Fund Your Account

After your application is approved, you’ll need to make an initial deposit to activate your account. The minimum deposit varies by bank and account type. You can fund your account through:

- Cash Deposit: Bring cash to the bank.

- Check Deposit: Deposit a check made out to your business.

- Electronic Transfer: Transfer funds from another account.

Ensure you meet the minimum deposit requirements to avoid any issues.

Step 7: Set Up Online Banking

Once your account is active, setting up online banking is crucial for managing your finances efficiently. Most banks will guide you through this process. Here’s what to do:

- Create your online banking profile using your business information.

- Set up secure login credentials, such as a strong password and two-factor authentication.

- Familiarize yourself with the online banking features, including bill payments, transaction tracking, and mobile banking options.

Having online access will make it much easier to manage your cash flow and monitor your business finances. (Read More: Maximizing Your Reach: How Meta Business Suite is Revolutionizing Digital Marketing in 2024)

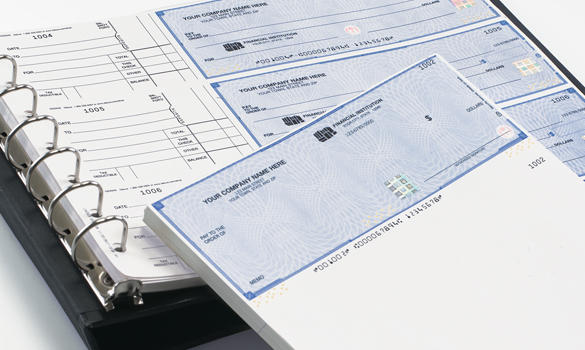

Step 8: Order Business Checks and Debit Cards

After opening your account, consider ordering business checks and debit cards. These tools are essential for day-to-day transactions. Most banks will allow you to order these during the account setup process or through online banking.

Business Checks:

- Useful for paying vendors, suppliers, or contractors.

- Ensure your checks have your business name and address printed for professionalism.

Debit Cards:

- Ideal for making purchases directly from your business account.

- Helps keep your business and personal expenses separate.

Conclusion article How to Open a Business Bank Account in 2024: Step-by-Step Instructions

Opening a business bank account in 2024 doesn’t have to be a stressful process. By following these step-by-step instructions, you can simplify the experience and set your business up for success. Remember, the right account will not only help you manage your finances but also provide valuable resources as your business grows.

Take your time to research and select the best bank and account type for your unique needs. With your new account, you’ll be well on your way to effectively managing your entrepreneurial journey. Happy banking!